Payroll deductions online calculator 2023

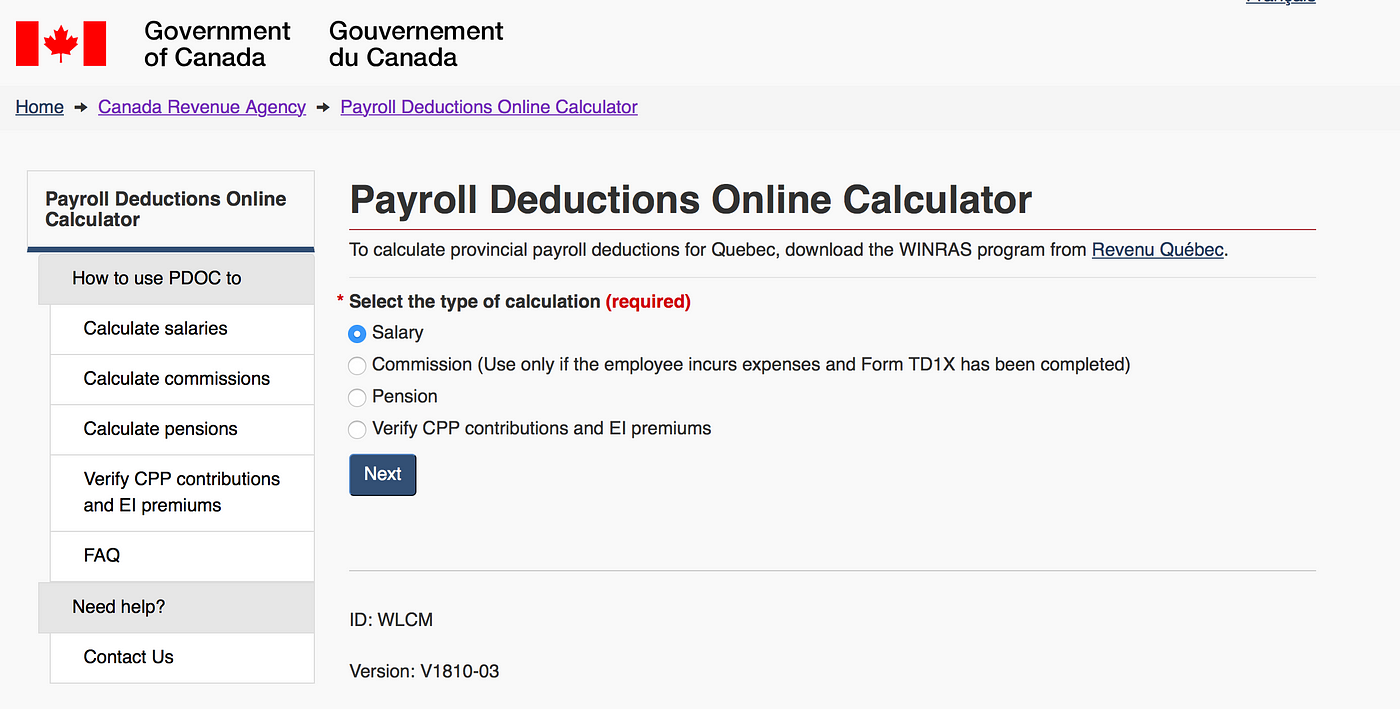

2021 Tax Calculator. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Tax On Pay Calculator Authorized Site 55 Off Aarav Co

Deductions from salary and wages.

. It will be updated with 2023 tax year data as soon the data is available from the IRS. Use our PAYE calculator to work out salary and wage deductions. Ad Process Payroll Faster Easier With ADP Payroll.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Under 65 Between 65 and 75 Over 75.

For example based on the rates for 2022. Free Unbiased Reviews Top Picks. 2023 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Use our employees tax calculator to work out how much PAYE and UIF tax. Employers and employees can use this calculator to work out how much PAYE.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Payroll withholdings include such taxes as state disability withholding state withholding federal withholding SUI payroll state taxes and other federal deductions and. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free.

Ad Process Payroll Faster Easier With ADP Payroll. Daily Weekly Monthly Yearly. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Proposed 2023 BAH increases are. All Services Backed by Tax Guarantee. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Free 2022 Employee Payroll Deductions Calculator. Ad Compare This Years Top 5 Free Payroll Software.

Use this simplified payroll deductions calculator to help you determine your net paycheck. It will confirm the deductions you. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Virginias maximum marginal income tax rate is the 1st highest in the United States. Ad Compare This Years Top 5 Free Payroll Software. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Get a free quote today. 2022 2023 Online 457 Payroll Tax Deduction Calculator Wage Calculator And Premium Impacts Minnesota Association Of Professional Employees Social Security Fund.

Free Unbiased Reviews Top Picks. The US Salary Calculator is updated for 202223. Get Started With ADP Payroll.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Form TD1-IN Determination of Exemption of an Indians Employment Income. The current rate is 55 percent and will be 60 percent effective July 1 2022 through June 30 2023.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Unbiased Reviews Top Picks. The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States.

Withholding schedules rules and rates are. For example if you earn 2000week your annual income is calculated by. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Payroll Guidelines for 2022-2023. Get Started With ADP Payroll. Under 65 Between 65 and 75 Over 75.

Estimate your federal income tax withholding. US Salary Calculators for 2022. 2023 Paid Family Leave Payroll.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Features That Benefit Every Business. Subtract 12900 for Married otherwise.

Ad Plus 3 Free Months of Payroll Processing. Ad Plus 3 Free Months of Payroll Processing. Start the TAXstimator Then select your IRS.

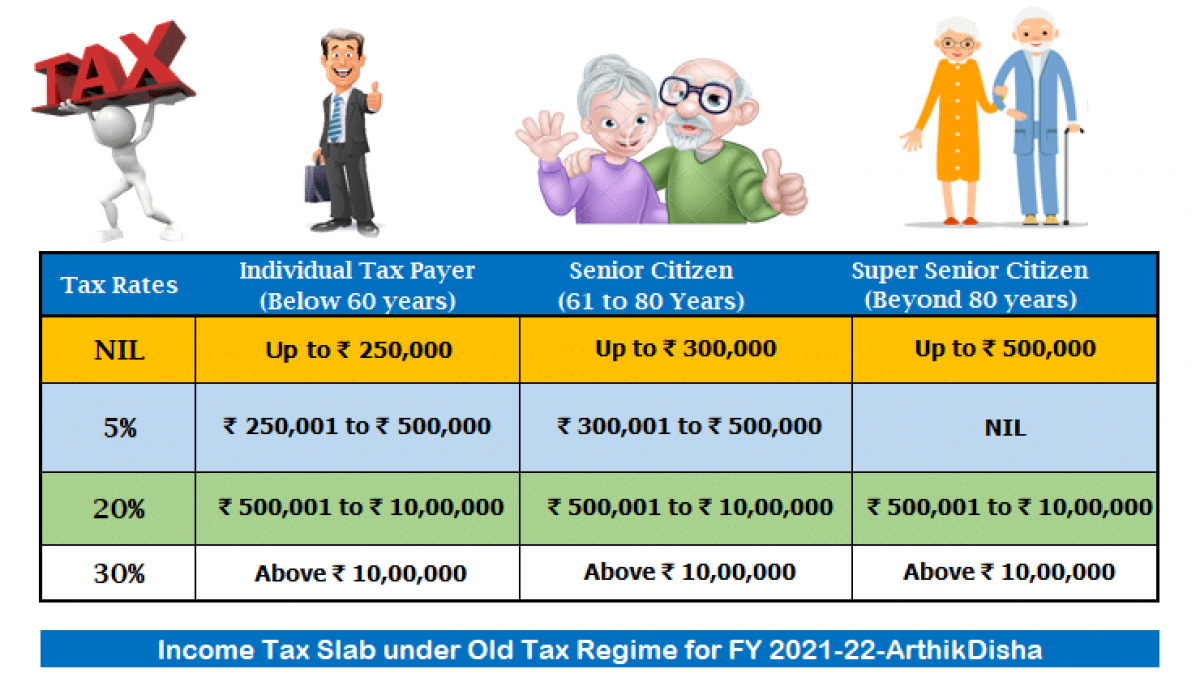

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download Fincalc

Payroll Tax Deductions Business Queensland

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download

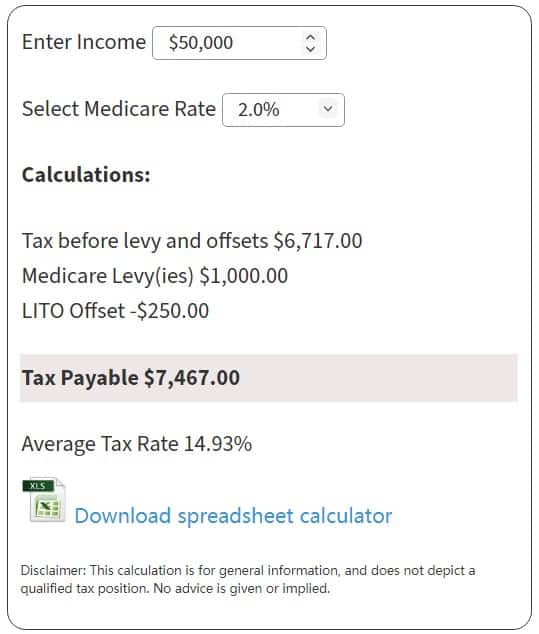

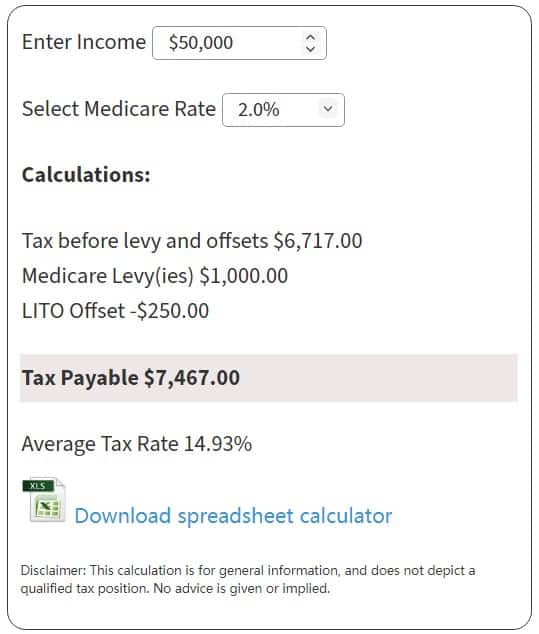

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

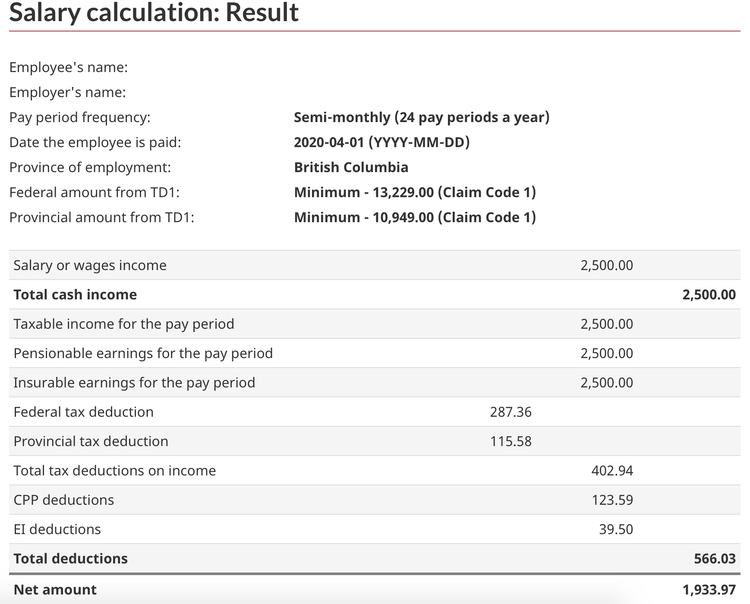

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

How To Do Payroll In Canada A Step By Step Guide

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Payroll Tax Deductions Business Queensland

Payroll Tax Deductions Business Queensland